Well the story starts like this…

I was getting ready to sit down for a birthday celebration for my 1 year old when I ran to the mailbox to see if she had received any new birthday cards. To my surprise I see a letter from my credit union with “URGENT” stamped on it in big red letters. “Oh No!” I think, not an overdraft notice, I was on top of my game and didn’t think I was in the trouble. Well boy was I wrong.

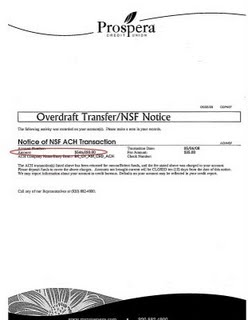

I open this letter and it says that I have a $546,020.00 NSF. YIKES!!!!

How can this be? I have an overdraft for half a million and all I get is a letter? No phone call, no personal attention??? What the… it says that I made a transaction to Banks of America for that amount? The darn card has only a $5,000.00 limit on it…

So thinking though the whole thing trying to figure out what happened… Here’s the deal. I went online to pay for my work corporate credit card. I had a $546.02 balance. Apparently I added a few extra zeros to the amount and quickly hit enter. Bam I had just transferred a half a mill to my corporate credit card. WOW. Seems odd that there is no check and balance system and that a credit card with a $546.02 balance can post a payment of over 1000 timers that amount. That just seems crazy.

Well the next day I have quite a conversation with the CFO of my local credit union. She was very sheepish over the whole thing. Apologized up and down for what had happened. My one big question to her was this…”At what level of an overdraft does the system kick this out and I get a phone call and not just a letter??”

She had no answer for me other then she would speak to the person working the overdraft area and make sure they are on the look out for this in the future. Not very comforting, but it is what it is. The big question was what Bank of America would say.

A few days later I did hear from someone at BOA. I heard from a Senior VP over corporate affairs and she said in her 30 years of banking experience, she has never seen anything like this. “I bet not I said!!” I asked how this could happen. In this day and age -with bank transparency at an all time high, why didn’t this get flagged? Isn’t there a system to see that a $5,000.00 credit limit card with a $546.02 balance doesn’t need a $500,000.00 payment?

She told me that their processing systems are over 20 years old and there is nothing like this for checks and balances built into the system…alarming really.

Isn’t it comforting to know that none our financial systems can catch a “butter fingers” like this? Makes you think, what else they don’t catch.

WOW!! The Consumerist picked up on the story Whoops: Typo Causes You To Overdraft $546,020.

That is awesome. At least the fee isn’t a percentage of the overdraft. That would have completely ruined my day!

Oh my God Tommy. That is ridiculous. I work at a bank that isn’t as major as BOA and even WE have a process of checking these things. I’ve never liked BOA anyway. I’ve had Wells Fargo since I was 16 and have never once had a problem, even if it was my mistake.

wait a minute?!? That was you??? I thought you just sent a link to an weird story.

Yes that was all me Sharon. My brush with fame.. Me oh me..oh my!

This is not surprising. I used to work for BOA. Banks are behind the technology curve. It takes a long time to create systems.

Within the first month of starting, I had $1500 taken out of my account from a debit card I never received. The bank wanted to research it a month before giving me the money. Fortunately, someone on my team knew someone in the bank and I was refunded the next day.